The Importance of Your Credit Score

A common credit card among teens.

January 31, 2019

As seniors we are starting to take on new responsibilities, some financial. One of these is building and maintaining a good credit score. For younger folks, building credit can be hard because we have zero credit history. Without a credit history, it’s hard to get a loan for college (by the way do not ever actually get a loan for college unless it is your last absolute choice; scholarships are definitely the way to go), a credit card, a car, or even an apartment.

Even though building a reputable credit score seems hard, it is doable. There are many ways to show credit companies that you have a good history of credit repayment even if you have never had credit.

A FICO score is a measure of consumer credit risk, which has become a fixture of consumer lending in the United States. Credit scores can range from 350 being very poor to 850+ being excellent. To start building this score you need to have an account that’s been open for at least six months and you need at least one creditor reporting your activity to the credit bureaus in those six months. Some things that creditors report to bureaus include if you are on time with your payments, or how much you pay when you repay.

Evelyn Contreras, 12th grade says “I think it’s important to build credit because it can either help or harm your payments in the future, for example, if i wanted to buy a car with good credit, i could put less money down if i have a good credit.”

Below are two ways in which you can start familiarizing yourself with the concept of credit, according to https://www.nerdwallet.com :

1. Getting a Secured Credit Card

If you’re building your credit score from the ground, it is smart to start with a secured credit card. These type of credit cards are backed by a cash deposit that is made upfront; the deposit amount is usually the same as your credit limit.

The card is basically a credit card but not quite; you buy things, make a payment on or before the due date, incur interest if you don’t pay your balance in full. Your cash deposit is used as collateral if you fail to make payments. The only difference between a regular credit card and a secured credit card is that once you close the account you receive you initial deposit back. Secured credit cards aren’t meant to be a forever credit card. The purpose of a secured card is to build your credit enough to qualify for an unsecured card A.K.A a regular credit card without a deposit and with better benefits. Make sure to research and choose a secured card with a low annual fee and make sure it reports to all three credit bureaus, Equifax, Experian and TransUnion.

2. Become an Authorized User on Someone Else’s Credit Card

This is a popular, easy yet risky way of building credit. If a family member (preferably a parent) may be willing to add you as an authorized user on his or her card, you’ll enjoy access to a credit card and you’ll build credit history, but you aren’t legally obligated to pay for your charges. However, if the primary owner of the credit card fails to pay repayments, it could possibly affect you in the long run so make sure you choose someone responsible.

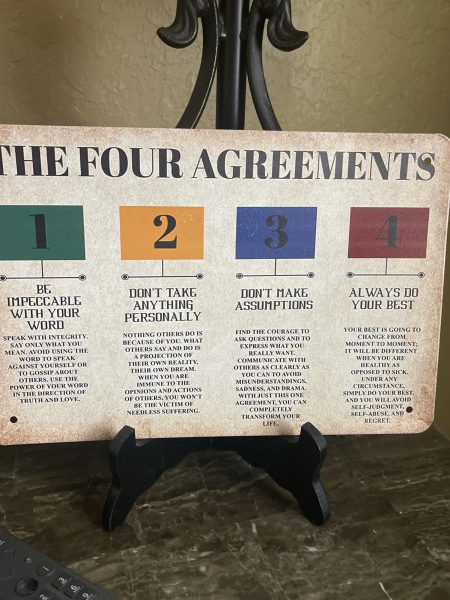

Below are habits every young person should get used to in order to build a great credit score:

- Make 100% of your payments on time, not only with credit accounts but also with other accounts.

- Keep the utilization of your credit card low (this is your balance when compared to your limit). It is a good habit to be paying in full each month.

- Avoid opening too many new accounts at once; new accounts lower your average account age, thus affecting your approval rate.

- Keep accounts open for as long as possible.

- Check each of your credit reports monthly for errors and discrepancies.

Emma • Nov 4, 2019 at 11:33 PM

The tips are wonderful! I’ve been meaning to learn all the hacks about credit score and you just came at the right timing, Thank you so much! Oh! I want to share this as well just read this a few moments ago https://www.htpenterprisesfinancial.com/5-great-ways-to-improve-your-credit-score-htp-enterprises-financial/ , it’s informational and interested post! Feel free to check.